Qubic Tax Newcastle

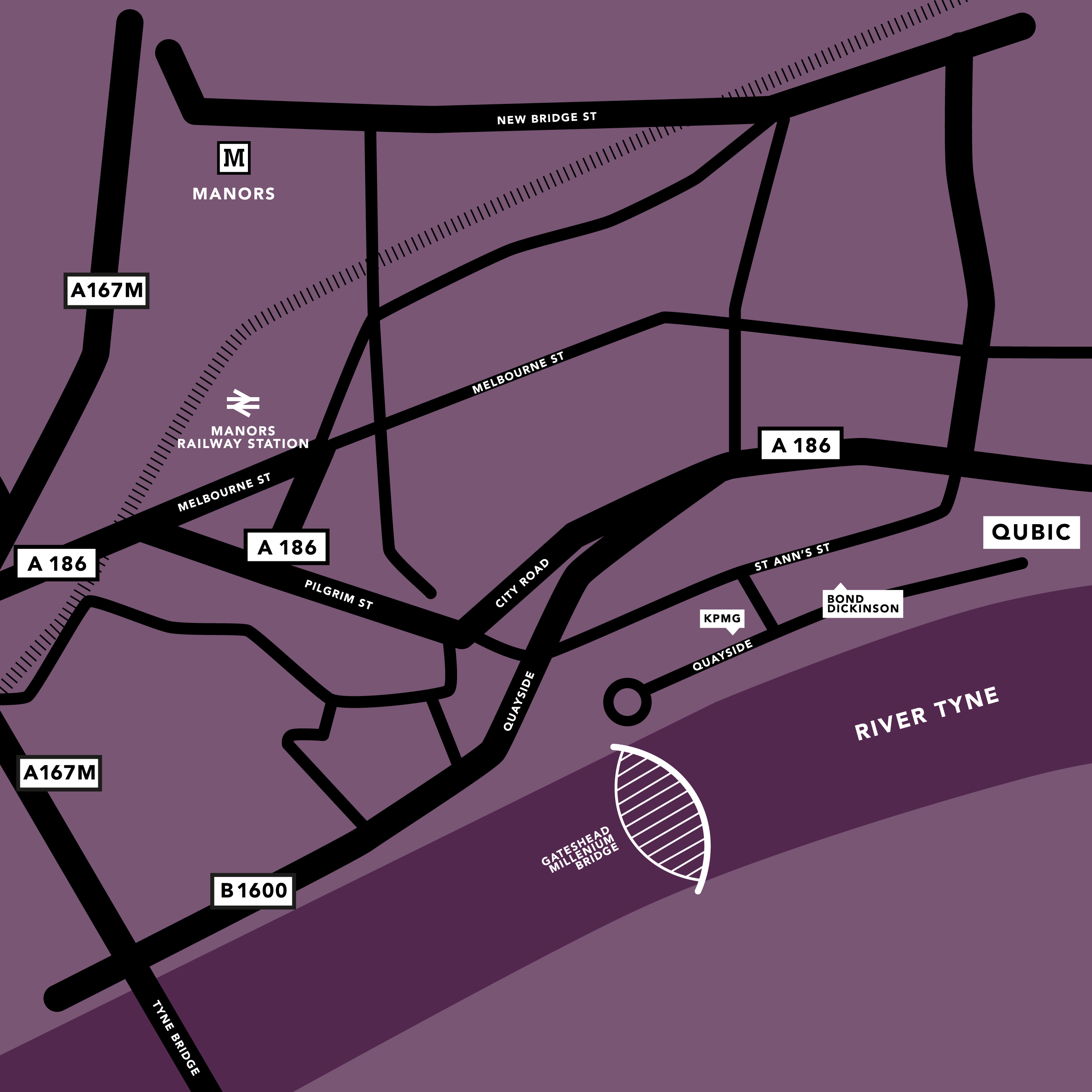

St Ann's Quay, 118 Quayside

Newcastle upon Tyne

Tyne and Wear

NE1 3BD

If you're ready, let's talk

Use the form below to request a call back, or email us directly at info@qubictax.com.