DOTAS was introduced on 1 August 2004 and has a number of tweaks since with IHT now also coming under the radar. This legislation requires that a promoter of a ‘disclosable’ scheme must provide HMRC with full details of the scheme and an explanation of how the scheme works, including the way in which a tax advantage is obtained. HMRC then issues a Scheme Reference Number (‘SRN’) known as the ‘DOTAS number’.

Whether or not disclosure is required will depend on interpreting the ‘hallmarks’ which have changed over time.

The problem for HMRC was that there could be a very long delay between HMRC recognising that someone has avoided tax, and then getting their hands on that tax.

This led to the introduction of the Accelerated Payment Notice or ‘APN’.

APNs and FNs: Guilty until proven innocent?

HMRC may issue an Accelerated Payment Notice in any of the following three circumstances:

- The taxpayer has entered into tax arrangements that have been subject to a ‘Follower Notice’ (“FN”)

- The taxpayer has entered into a tax arrangement that has been the subject of a GAAR (General Anti Avoidance Rule) counteraction notice or

- The taxpayer has entered into DOTAS notifiable arrangements

An FN can be issued by HMRC to a taxpayer where HMRC ‘is of the opinion’ that the taxpayer’s appeal or claim is effectively covered by an existing decision of the tax Tribunals or Courts i.e. it follows a previous final decision. There is no right of appeal against HMRC’s FN although the taxpayer can make written representations to ask HMRC to reconsider. Otherwise, if the taxpayer does not take appropriate corrective action in the next 90 days, (i.e. amending their Return to reflect the decision in the other case), they can be subject to a penalty equal to 50% of the denied tax advantage if they lose the subsequent litigation.

The Rangers FC decision by the Supreme Court has resulted in the greatest number of FNs to date as HMRC contend the ruling affects the majority of Employee Benefit Trust (EBT) and Employer Funded Retirement Benefits Schemes (EFRBS) or similar ‘Disguised Remuneration’ planning. HMRC also introduced the “2019 Loan Charge” legislation as a further last stop if the tax planning involved loans. Legislation that was, in essence, retrospective because the 2019 charge could apply to relevant loans taken out since April 1999.

In terms of the third category, an APN may be issued to any taxpayer who has entered into DOTAS notifiable arrangements provided there is an open HMRC enquiry into a return or claim made by a taxpayer, or that there is an open appeal against an assessment or determination. There is no consideration as to whether the tax planning ‘works’ or not and the justification for this is provided by the HMRC statement that “There is no inherent presumption that tax in dispute should sit with the taxpayer rather than the Exchequer.”

Only representations can be made against an APN notice, there is no right of appeal in the same way as an FN. The case could be taken to the courts by way of a Judicial Review but the chance of success there is slim based on the cases heard to date.

POTAS

HMRC introduced a raft of legislation aimed at the Promoters of Tax Avoidance Schemes (“POTAS”)(FA 2014 Part 5 & Schs 34-35). There is insufficient space to describe these in any detail (HMRC’s guidance runs to 93 pages). Many such promoters ceased to trade and/or stopped providing support to users of their schemes. (The above is based on an article that Dave Jennings co-authored for the Law Society PS magazine in May 2015)

It is recommended that those considering tax planning arrangements take into consideration the following points which Qubic Tax would be happy to discuss further with you to better understand the inherent risks of certain tax advice.

Planning arrangements

There is always a risk of any planning arrangement being enquired into by HMRC in relation to any person, be it a company or an individual. Enquiries of this nature can take several years, during which time HMRC may make various requests for information and documentation, and the persons should endeavour to be as transparent and cooperative as possible. Any act which deliberately conceals or fails to disclose documents can carry very serious sanctions, including criminal charges.

Litigation

HMRC may of course take a contrary view of the tax treatment of the arrangements. If that occurs and the related tax position cannot be agreed upon by mutual agreement or arbitration, then litigation via the Tax Tribunal(s) and ultimately the courts may be required to determine matters. It should be appreciated that, as a result of any such litigation, the proposed arrangements may be found not to result in the tax advantage which they may be expected to at the outset. This could conclude in tax, interest and penalties applying, and sometimes not necessarily the same amount of tax that the person may have otherwise incurred had an alternative cheaper approach been taken at the start.

GAAR and Promoters

For your information, HMRC publish guidance in relation to taxation issues generally online (https://www.gov.uk/government/organisations/hm-revenue-customs ). The guidance covers topics such as the General Anti Abuse Rules (https://www.gov.uk/government/collections/tax-avoidance-general-anti-abuse-rule-gaar) introduced by the Finance Act 2013 legislation, and contains information regarding penalties at Part 5 of the legislation where a contravention is deemed to occur. They also publish non legislative material which may be illustrative of their wider policy and approach at any particular time. This sort of material includes leaflets such as “10 things a tax avoidance promotor won’t always tell you” which provides illustrative aspects firms may wish to be aware of where they are considering schemes or wider planning which seems in many cases as too good to be true. These are listed as follows:

- Most schemes don’t work. You may be told that avoidance is legal, but if the scheme doesn’t work you’ll have made an incorrect tax return which is not in accordance with the law. You are legally obliged to pay tax that is due and you may be charged penalties if you try to avoid it.

- It could cost you more than you bargained for. Avoidance schemes are complex. They can give rise to unintended additional tax consequences, and the fees you pay the promoter do not count as tax paid. So you could end up paying much more than just the tax you’re trying to avoid.

- You may have significant legal fees to pay. If the scheme is taken to litigation, you’re likely to have hefty legal fees to pay. Your promoter may ask you to pay into a ‘fighting fund’ up front.

- You could face criminal conviction. If you deliberately mislead or conceal information from HMRC you could be prosecuted and convicted.

- You could face publicity as a tax avoider. If you are named in court papers when the case is litigated, or in public registers, you could be reported in the media as a tax dodger.

- Your scheme is never HMRC approved. Getting an avoidance Scheme Reference Number from HMRC doesn’t mean the department has cleared the scheme. HMRC issues these numbers when a scheme has signs of being designed to avoid tax.

- You could be marked out as a high-risk taxpayer. Use of a scheme could mark you out as a high-risk taxpayer, which means that all of your tax affairs will be closely scrutinised in future, not just your claim for relief.

- HMRC is likely to beat your scheme in court. HMRC wins eight out of ten cases where taxpayers and promoters take avoidance schemes to court.

- The risk is normally all your own. It’s unlikely that a promoter will give you a guarantee that a scheme will work. And they probably won’t be around to support you once HMRC starts investigating your tax affairs. Some promoters set up simply to sell the scheme, and then disband.

- You’ll have to pay the tax up front anyway. You won’t get a cash-flow advantage while HMRC investigates a scheme. New legislation means you’ll have to pay the disputed tax up front.

Policy and Retrospective Tax Changes

The views of HMRC and the judiciary regarding taxation principles and the tax treatment of planning arrangements do change over time and care needs to be given as to how transactions may be perceived in the future although it is difficult to predict those circumstances and policy.

The introduction of future retrospective tax legislation cannot be ruled out following the comments made by the Government in the Autumn Statement 2015 and more recent legislation enacted against transactions undertaken almost 20 years ago which affected the basis on which they were taxed (the 2019 Loan Charge). More mainstream changes have also occurred which illustrate this example such as changes to pensions rules as to how they are taxed when drawn, often years after funds were first contributed). The introduction of any such future retrospective tax legislation could adversely impact, or potentially even reverse current tax benefits.

How can Qubic Tax provide assistance?

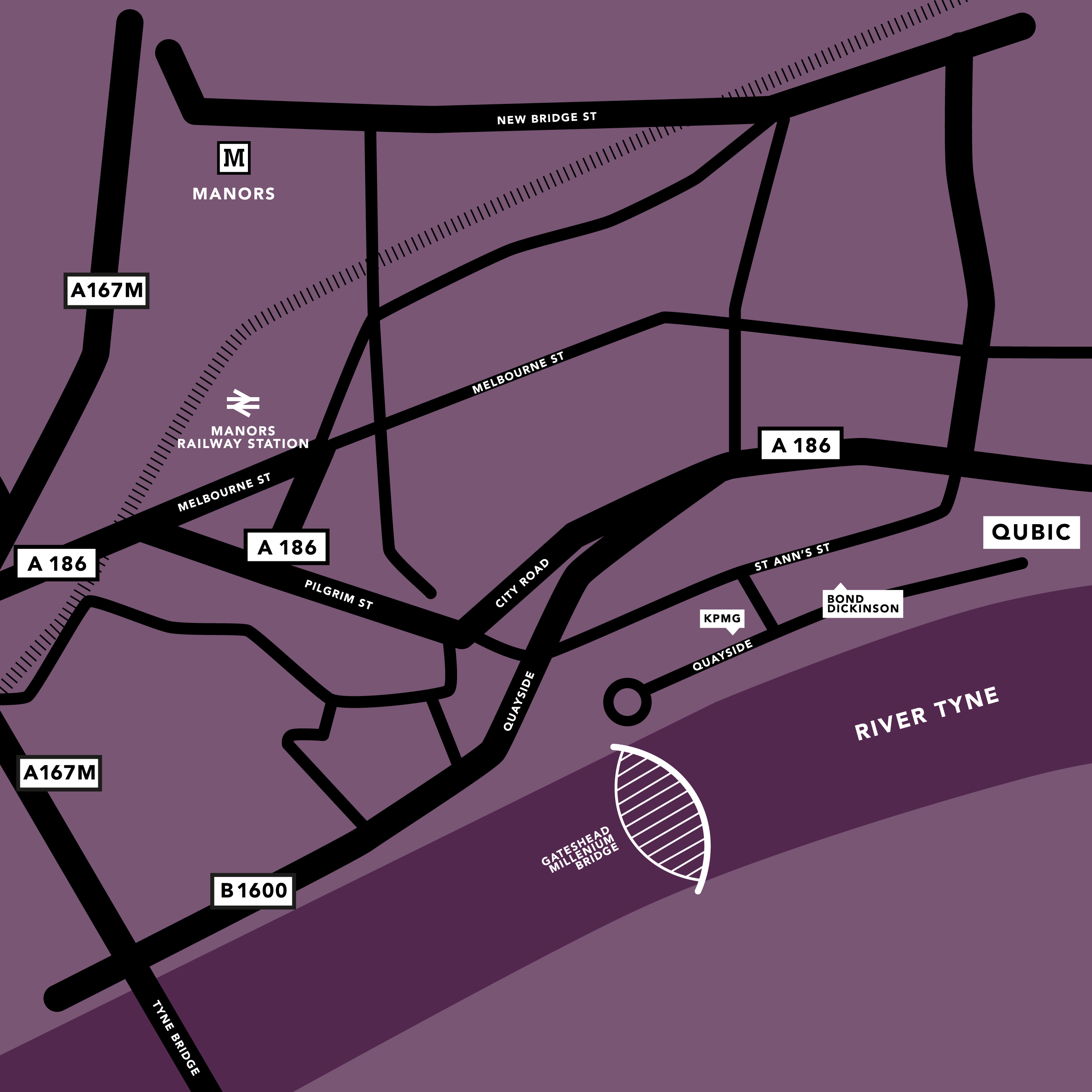

If you are considering tax planning arrangements, or have participated in tax planning and would like to discuss how new developments affect their arrangements or explore ways of taking any historical disputes with HMRC forward, please see more information here or get in touch with us on 0191 2322001 / 0207 2839555 or email info@qubictax.com with your query. Our tactics are tailored to each individual case, and with the enquiries and disputes landscape constantly evolving, together with changes to the appeals, reviews and tribunals processes, we can offer alternative and creative solutions with all of these changes in mind.